10X Supercharged

Debt Collection Debt Recovery Optimization

End-to-End AI Powered Debt Collection Platform

Supercharge Debt Collections with AI

10X Efficiency. Zero Hassle.

We Let Numbers Speak

500Cr+

Annual AUM

30+

Enabled Lenders

40% Increased

Collections Efficiency

5Mn+

Loan Accounts

Why Neowise?

Our AI-powered, end-to-end Debt Collection platform automates loan recovery and collections, using advanced data-driven engines and predictive insights to streamline your loan recovery workflow improving efficiency and boosting results across the board.

Effortless as it should be

Automate AI-Driven Conversations for Smarter Debt Recovery

One Unified Loan Collection Platform for End-to-End Collections Management

Design Custom Debt Recovery Plans Backed by Intelligent Data Insights

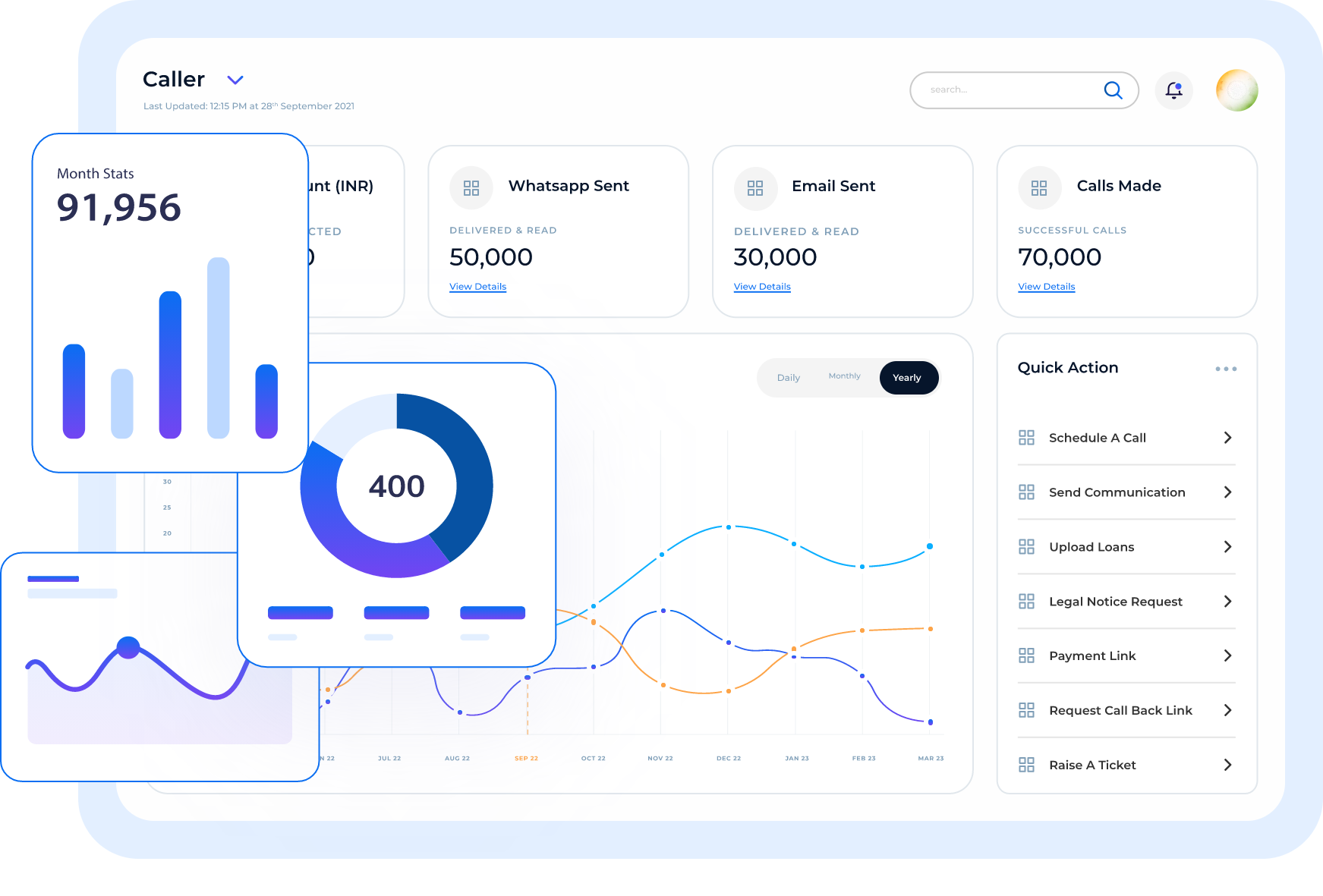

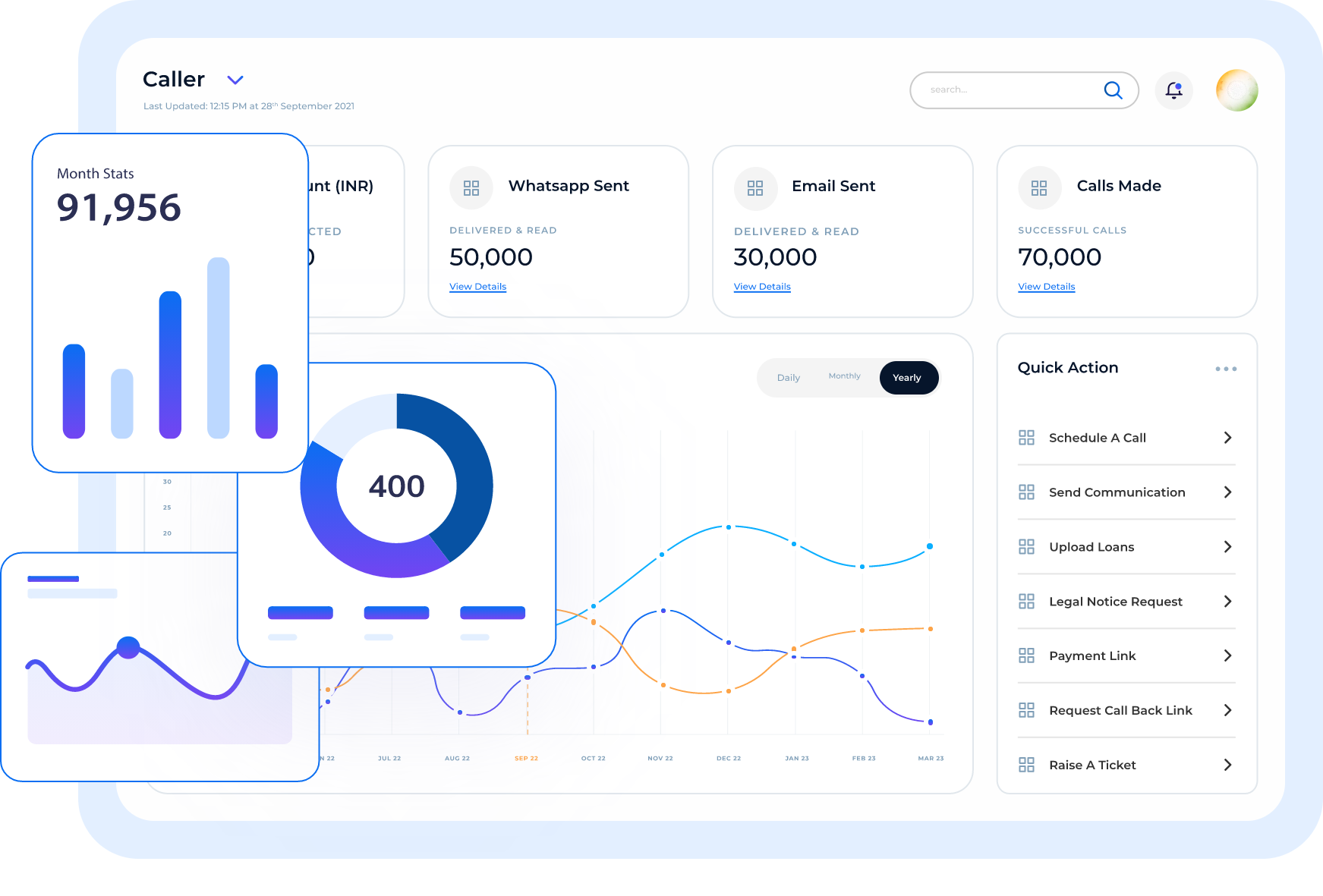

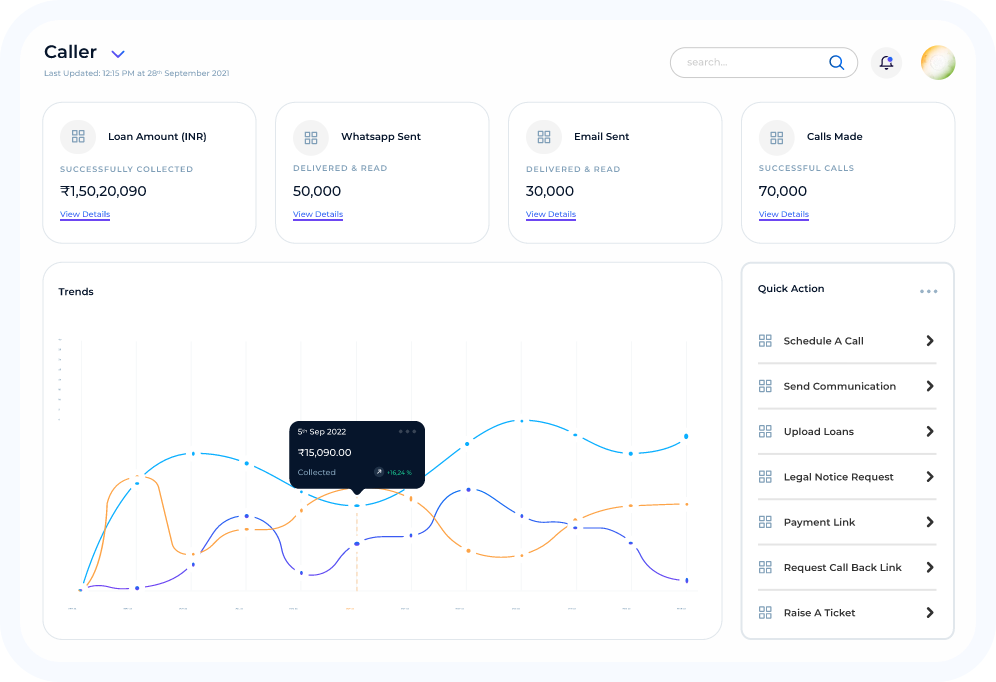

Seamlessly Consolidate Data into an AI-Powered, Intuitive Dashboard

Single-Click Compliance Checks to Simplify Loan Collections

Power Your Debt Collections with AI

Convert Past Dues to Revenue

10X Efficient Debt Collection with Advanced Solutions

AI-Driven Communication with Neobot

Automate and personalize your outreach with AI-powered bots. Schedule SMS, WhatsApp, Email, IVRS, and AI Bots for customer segments, ensuring multilingual campaigns that maximize debt recovery and engagement.

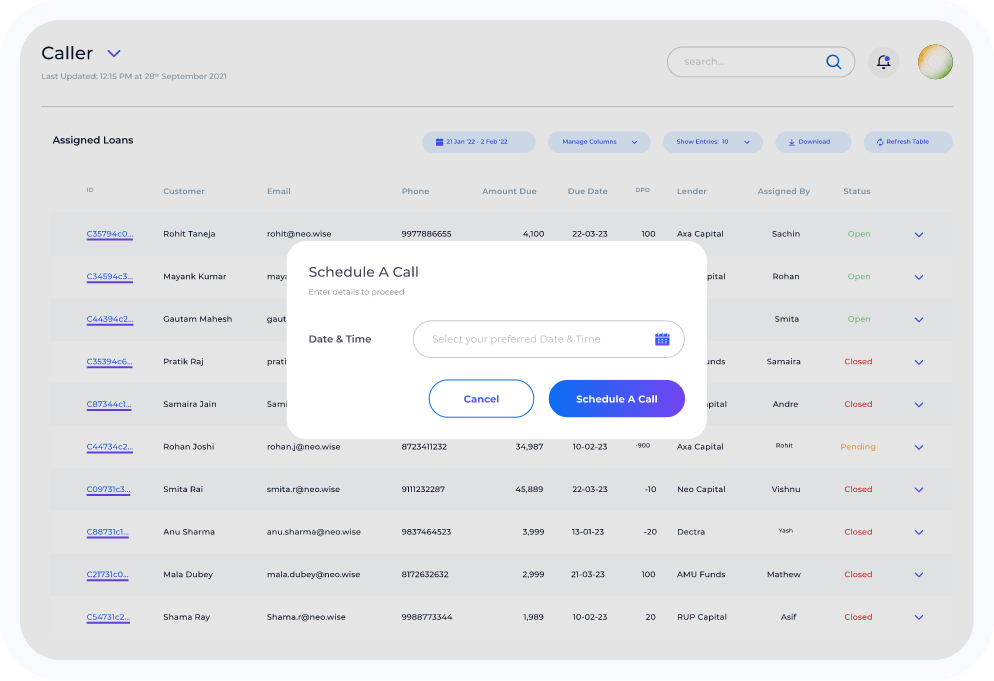

Empower Tele-Calling with Smart Automation

Use automated call scheduling for your loan collection agents, prioritising contactable cases with the help of AI. Enjoy a seamless dialer interface, ensuring agents focus on the highest-value resolutions.

Enhance Agent Performance with Real-Time Data

Propel your field agents with a state-of-the-art app that offers real-time data insights, task management, geo-tracking, and reporting, driving increased efficiency and success rates on the ground.

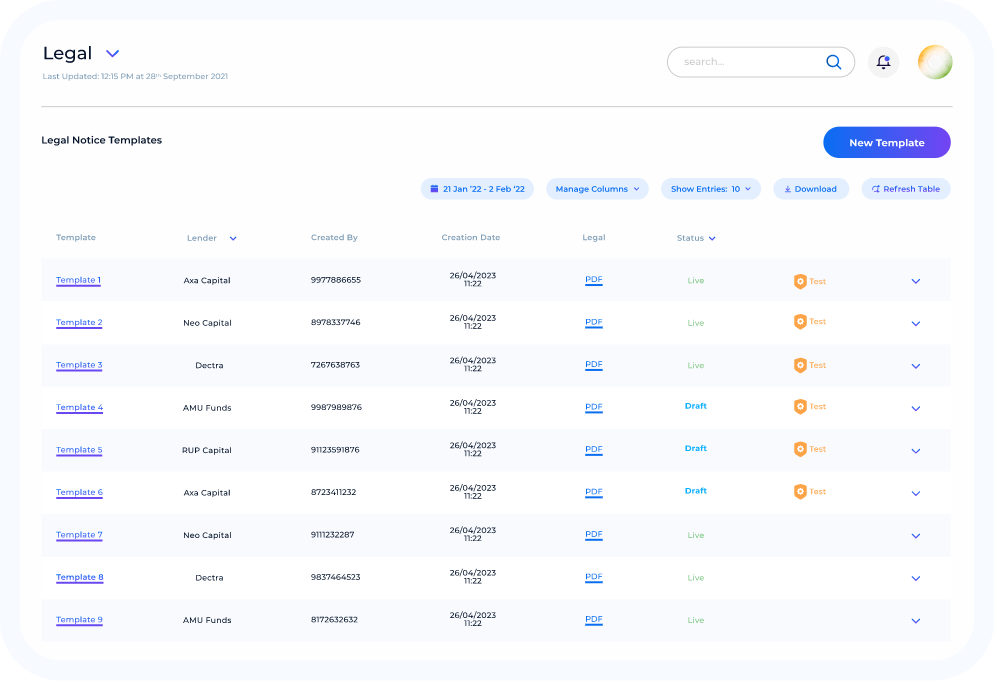

Simplify Legal Workflow

Streamline litigation tracking and outcomes with an integrated legal case management system. Gain end-to-end visibility into your legal processes with our legal recovery services, ensuring compliance at every stage.

Built For Lenders

Personal

Loans

Auto

Loans

Electric

Vehicles

Buy Now

Pay Later

Healthcare

Services

Earned Wage

Access

Digitise & Consolidate Your Debt Recovery Journey Today

Insights-Driven Borrower Engagement

Recover More Loans, with Fewer Resources

Boost Efficiency & Unlock Peak Performance

Slash Communication Costs with Smart Automation

Seamless Compliance, On Auto-Pilot

Deploy Quickly, with Responsive Support

Supercharge Your Debt Collections

Ready to transform your NPAs into revenue-driving assets?

Real Voices. Real Results

60% Recovery Rate

Automated DPD 1-5 Debt Collection Solution

Discover how Neowise’s AI-powered NeoBot achieved 60% recovery rate for DPD 1-5 collections with zero human intervention. Transform your NPAs today.

87% ROR Achieved

Cross-Regional DPD 1-30 Debt Recovery Success

Discover how Neowise’s integrated approach delivered 87% ROR for cross-regional NBFC collections. DPD 1-30 portfolio transformation in South India.