Welcome to Neowise

A leading provider of End-to-End Collections Enablement Technology and Services.

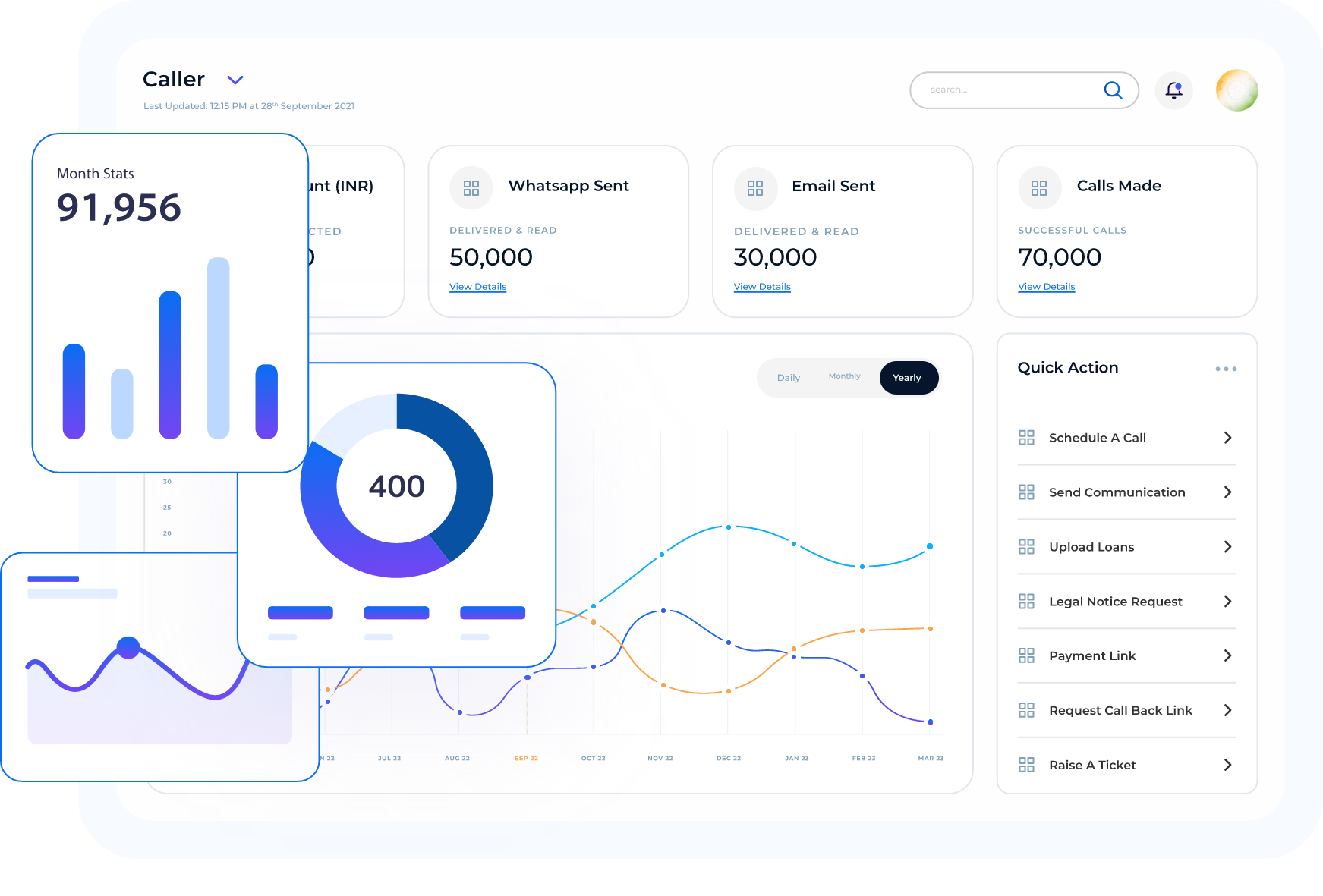

Supercharge Debt Collections with AI

10X Efficiency. Zero Hassle.

With the mission of revolutionising the collections industry, we at Neowise have set out on the challenge to empower lenders with innovative solutions that streamline and optimise their collections processes.

Our first hand lending industry experience makes us understand the challenges of managing collections effectively. Hence, to solve this gap, we joined forces with Decentro, a leading Banking and Infrastructure company in 2023, to expand our capabilities, expertise, and reach in ways that will redefine collection industry standards.

Experience the transformative power of Neowise’s End-to-End Collections Enablement Technology. Join us to achieve collections excellence, drive financial success, and build lasting customer relationships.

Contact us today to learn more and start your collections enablement journey.

Meet The Founder

With a strong network in India’s financial services industry, Rohit brings invaluable expertise to Neowise. Having worked at esteemed organizations like Nomura and EPS, he leads the business with a sharp focus on Strategic Alliances, Product & Technology, and Compliance. Rohit’s extensive experience allows him to forge strategic partnerships, drive innovative product development, and ensure compliance with regulatory standards. His leadership and industry insights play a pivotal role in propelling Neowise towards growth and success.

Rohit Ramachandran

Co-founder & CEO

Accelerate Your Collections

Ready to turn past due into revenue?

Frequently Asked Questions

Neowise empowers businesses with advanced tools and features to enhance collections performance. It enables efficient management of loan portfolios, communication channels, compliance, and more, resulting in improved collections outcomes.

Every new clients is paired with a dedicated onboarding manager who will be there each step of the way to set you up for success, help implement best automated collection practices and guide you to Go-Live as early as possible.

Absolutely! Once onboarded, you will also have access to a dedicated Account Manager and have access to support whenever you need to access it, via email, phone or logging a support ticket with our team.